The rise in phishing attacks has become a global concern, striking with increasing sophistication and leading to significant financial losses, and a great needed for anti-phishing regulations.

Singapore, a hub for digital innovation, has felt the impact keenly, highlighted by OCBC Bank’s reported jump in phishing-related losses from S$8.5 million to S$13.7 million. This spike has propelled regulatory shifts aimed at strengthening cyber defenses.

It’s important to understand Singapore’s evolving anti-phishing regulations, dissecting how new measures affect banks, telcos, and consumers. In this blog, we’ll clarify the roles and responsibilities these entities play in the fight against phishing, offering insights into Singapore’s strategy to safeguard digital spaces.

Did you know? The Origin of “Phishing”: The term “phishing” is a play on the word “fishing,” representing the cybercriminals’ tactic of “fishing” for sensitive information from unsuspecting victims. It was first used in the mid-1990s with the alteration in spelling influenced by the early hackers’ tradition of using “ph” in place of “f.”

OCBC’s Alarm: A Catalyst for Change in Cybersecurity Measures

In Singapore, a nation celebrated for its digital prowess, the threat of phishing scams has sharply escalated, reflecting a broader global security crisis.

OCBC Bank’s alarming report of financial losses soaring from S$8.5 million to S$13.7 million, alongside the victim count jumping from 469 to 790, highlights the growing menace these scams pose. This uptick is not just a local concern but a vivid illustration of the widespread impact on financial and data security worldwide.

Phishing scams, through deceitful means to extract sensitive information, pose a grave threat to the financial well-being and personal security of individuals and organizations, emphasizing the urgent need for enhanced cybersecurity vigilance globally.

Singapore’s Smart Nation Initiative: Singapore aims to be a “Smart Nation,” leveraging digital technology to enhance living and working environments. This ambitious goal has made cybersecurity a critical priority, given the increased digitalization of public services and financial transactions.

Singapore’s response to the phishing epidemic is a pioneering shared responsibility framework, crafted by the Monetary Authority of Singapore (MAS) and the Infocomm Media Development Authority (IMDA). This framework delineates clear roles and responsibilities for financial institutions and telecommunications companies (telcos) in the battle against phishing scams, setting a precedent for collaborative cyber defense.

Under this innovative model, the accountability for preventing phishing scams cascades down a “waterfall approach”. Initially, financial institutions, as custodians of consumer finances, bear primary responsibility. They are tasked with implementing stringent security measures to thwart unauthorized transactions.

Should these measures fail, the responsibility shifts to telcos, which support digital security through their control over SMS and communication channels, often exploited by scammers.

This approach not only clarifies the duties of each party but also encourages a proactive stance against phishing, ensuring that both financial and telecommunication sectors work in tandem to safeguard consumers. By establishing discrete, well-defined roles, Singapore’s regulatory framework aims to fortify its digital ecosystem against the scourge of phishing, setting a benchmark for global cybersecurity strategies.

Frontline warriors: The crucial role of financial institutions

The new framework outlines specific duties for financial institutions and telcos, adopting a “waterfall approach” for accountability. Financial institutions are at the forefront, tasked with securing transactions against phishing threats.

If a breach occurs, telcos, managing SMS and communication channels often exploited by scammers, are next in line for responsibility. This structured approach aims to enhance proactive defenses, ensuring a united front between financial and telecommunication sectors to protect consumers in Singapore’s digital landscape.

AI in Cybersecurity: Singapore banks and telcos are increasingly using Artificial Intelligence (AI) to detect phishing attempts. AI systems can analyze patterns and anomalies in data that would be impossible for humans to detect at scale, acting as an advanced guard against phishing.

The telco barrier: Strengthening communication channels against scams

Singaporean banks are the frontline against phishing, tasked with securing transactions and educating customers to prevent fraud. They must deploy rigorous security measures and transaction verification to thwart scams.

Failing these duties can lead to substantial financial and reputational damage, exemplified by the OCBC incident, where phishing scams led to losses of S$13.7 million. Such failures expose banks to not just immediate financial losses but also long-term trust erosion and potential regulatory repercussions.

Anti-Phishing Regulations: The Frontline of Personal Cybersecurity

Under Singapore’s new anti-phishing regulations, telcos are expected to play a crucial role by implementing scam filters and managing the SMS Sender ID Registry to curb scam SMS cases. These measures are designed to tighten security around communication channels often exploited by scammers.

The effectiveness of these initiatives is evident, with a reported significant reduction in scam SMS cases, showcasing the positive impact of these regulatory expectations on enhancing digital security and protecting consumers from phishing activities.

The concept of the “human firewall” emphasizes the role of individuals in cybersecurity. Just as a traditional firewall protects against external digital threats, educated and vigilant individuals can act as a barrier against phishing by recognizing and avoiding potential scams.

The ripple effect: Implications for financial institutions and telcos

Consumers bear essential responsibilities in the fight against phishing, including:

- Not Sharing Credentials: Avoid giving out login details or one-time PINs to unverified sources.

- Being Cautious of Suspicious Links: Exercise caution when clicking on links from unknown or unsolicited sources.

Despite these precautions, consumers might still face losses if they negligently share information or ignore security alerts. This highlights the need for constant vigilance and informed awareness among consumers to protect against the financial and personal risks posed by phishing attacks.

Singapore’s anti-phishing regulations carry significant implications for both the financial sector and telecommunications industry, requiring them to bolster defenses and collaborate more closely in combating cyber threats. These anti-phishing regulations aim to enhance digital security but also present several challenges and potential criticisms:

- Impact on Consumer Trust: While designed to protect consumers, stringent measures could lead to increased scrutiny and possibly erode trust if customers feel overly surveilled or burdened by security protocols.

- Implementation Feasibility: The complexity and cost of implementing advanced security measures and compliance with the new anti-phishing regulations may strain smaller institutions and telcos, raising concerns about the equitable distribution of responsibilities.

Singapore is exploring blockchain technology for its potential to secure online transactions and prevent phishing. Blockchain’s decentralized nature makes it much harder for cybercriminals to tamper with or forge transaction records, offering a futuristic shield against phishing scams.

Singapore’s United Front Against Phishing

As phishing scams evolve, Singapore’s regulatory frameworks must adapt to outpace these cyber threats. The future of anti-phishing efforts will likely see more sophisticated scams, necessitating continuous innovation in security technologies and regulations. Key to this adaptability will be the collaboration among regulators, financial institutions, telcos, and consumers, ensuring a united front against phishing.

Leveraging Bolster for advanced phishing protection: A strategic approach

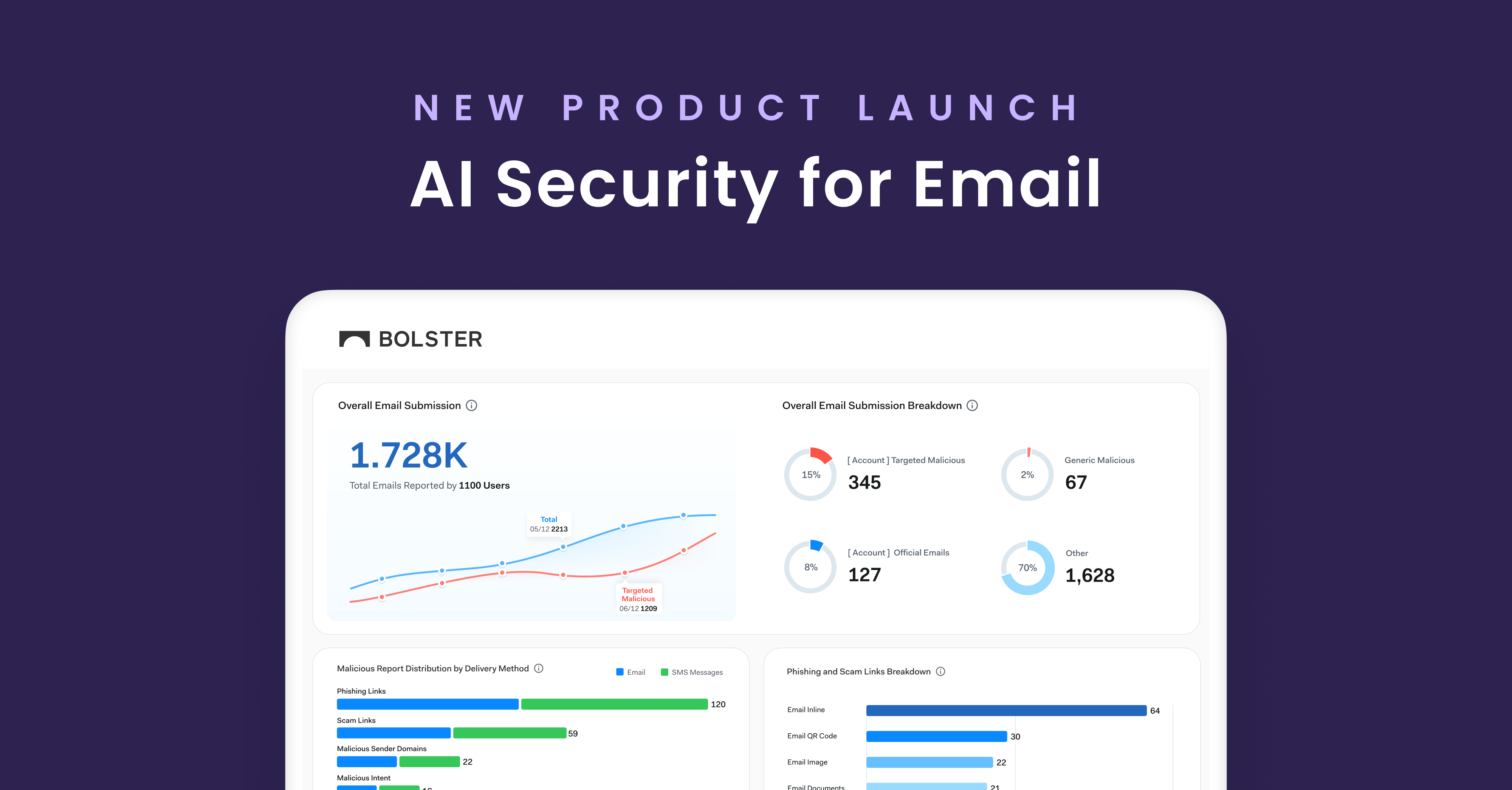

In the face of escalating phishing threats, businesses require robust defenses to protect their digital integrity and financial assets. Leveraging advanced technology like Bolster is key to establishing a formidable security posture against such cyber risks.

Bolster’s platform, powered by artificial intelligence and machine learning, offers an innovative approach to preemptively detect and neutralize phishing attempts. This ensures businesses can safeguard their operations against the sophisticated tactics employed by cybercriminals.

With Bolster, cyber risk teams can combat attackers using:

- Real-Time Threat Detection: Utilizing AI to monitor and analyze web traffic for signs of phishing activity, providing immediate alerts.

- Deep Web Intelligence: Scanning the depths of the internet to identify emerging threats before they reach corporate networks.

- Automated Response Mechanisms: Automatically neutralizing identified threats, reducing the need for manual intervention and speeding up response times.

- Employee Training and Awareness: Enhancing cybersecurity education programs by using real-life examples of phishing attempts identified by Bolster’s LLMs.

- Regulatory Compliance: Assisting businesses in meeting cybersecurity regulations through comprehensive threat analysis and reporting capabilities.

Incorporating Bolster into a business’s cybersecurity strategy not only enhances protection against phishing attacks but also aligns with modern requirements for digital safety and regulatory compliance.

Bolster’s platform leverages an AI that’s been trained on millions of phishing examples, essentially becoming a cyber detective that never sleeps. This AI can distinguish between benign and malicious content with astonishing accuracy, turning the tide in the digital battle against phishing scams.

See how Bolster can identify phishing scams targeting your business and consumers, and stay ahead of looming phishing regulations. Request a demo with our team today.