The Unified Payments Interface (UPI) introduction has revolutionized financial transactions. Its ease of use, speed, and simplicity have attracted millions of users. However, popularity grows for UPIs, so do UPI-related scams.

Fraudsters continuously devise new methods to exploit unsuspecting individuals, making it crucial to follow cybersecurity best practices and stay vigilant to protect your finances from hackers.

Payments fraud is a constantly evolving challenge in the financial landscape, affecting businesses of all sizes. Understanding the trends, methods, and strategies to combat payment-related fraud is essential for mitigating risks and safeguarding assets.

Payment Fraud Methods

When looking into websites where payment is required, either while booking accommodations or paying for apparel, Bolster observed 2,062,348 phishing domains from January through the end of June 2024. In the entirety of 2023, we saw 3,519,880 phishing domains targeting booking accommodation or apparel payment pages. If the current rates continue at the same speed in 2024, we predict there will be a rise of almost 15% of pages year over year.

From all the websites we have observed, hotels and accommodation booking websites are the top contenders for UPI and payment-related victims.

Understanding the origins of payment fraud is important for developing effective prevention strategies. Fraud regularly originates from organized crime syndicates, rogue employees, or individual hackers. These perpetrators exploit weaknesses in protection protocols, human mistakes, and old technology to execute their schemes.

Regular security assessments, employee schooling, and investment in superior cybersecurity measures are important for decreasing the impacts and success rates of fraud.

Various payment methods and fee collection techniques are vulnerable to fraud, each with its specific vulnerabilities. Some of the most impacted techniques include:

Credit and Debit Cards

Credit and debit cards, essential for modern transactions, face significant risks from payment frauds like skimming, cloning, and CNP (card-not-present).

Skimming

Skimming refers to the illegal exercise of capturing facts from the magnetic stripe of a credit score or debit card. This is usually carried out using a tool known as a skimmer, which is frequently disguised and attached to valid card readers, including ATMs, fuel pumps, or factor-of-sale terminals. The skimmer records the card details when a card is swiped or inserted into the compromised reader.

These stolen records can then be used to make fraudulent purchases or to create counterfeit cards. Skimming is a common method criminals use to obtain financial information from unsuspecting individuals.

Cloning

Cloning in cybersecurity is where hackers illegally copy credit or debit card details onto a fake card. This procedure takes the data off the card and puts it on another card, usually using the chip or magnetic stripe. The cloned card is usually used by thieves to make unauthorized transactions or withdrawals, frequently without the original cardholder’s knowledge.

Cloning is a major threat to financial security that can happen through various methods, such as skimming devices or data breaches. Effective security measures and vigilant monitoring are necessary to prevent and identify this type of financial fraud.

CNP

CNP (Card-Not-Present) transactions refer to payments made where the physical credit or debit card is not presented to the merchant during the transaction. This commonly occurs in online purchases, over-the-phone orders, or mail orders, where card details are manually entered or transmitted electronically.

While convenient for consumers, CNP transactions pose higher fraud risks than in-person transactions because verifying the card and cardholder identity is more challenging. Merchants and payment processors employ stringent security measures, such as CVV verification and advanced fraud detection systems, to mitigate these risks and safeguard against unauthorized card information use in CNP environments.

ACH and Wire Transfers

Wire transfers and ACH (Automated Clearing House) transfers have different uses in financial transactions. Because ACH transfers are executed in batches and are mostly used for domestic payments, they are economical for regular activities like bill payments and salary deposits. Due to being automated in nature, they usually take a few business days to complete, but they are dependable for recurrent transactions.

Conversely, wire transfers offer instantaneous, real-time money transfers between accounts within and across national borders. They are the go-to option for pressing transactions where time is of the essence, such as emergency financial transfers or real estate closings. Wire transfers are more expensive than ACH transfers, but they provide unmatched ease and quick fund availability, which makes them essential for some financial transactions.

Mobile Payments

The increasing popularity of mobile payments is accompanied by a growing risk of cyberattacks that take advantage of holes in mobile applications and relaxed authentication procedures. While convenient, mobile payments made using smartphones and tablets through specialized apps also draw in hackers looking to take advantage of holes in-app security.

Via malware, phishing, or the exploitation of unsecured network connections, these vulnerabilities can be exploited to steal personal data, including credit card numbers. Inadequate authentication techniques further raise the possibility of unwanted access to user accounts, such as using PIN codes or weak passwords.

Learn more about malware vs ransomware

Robust security measures, such as frequent app upgrades, reliable authentication methods like biometrics, and user education on safe mobile payment practices, are crucial to reducing these threats and securing users’ financial information in the evolving landscape of mobile payments.

The Scammers Blueprint

Know Your Target

For scammers to execute effective fraud operations, precise information about their targets is essential. Scammers frequently get this information using various illegal methods, such as buying databases that include private information discovered through insider hacks or data breaches.

For example, information about potential victims’ precise personal details can be obtained by fraudsters through the leakage of data from cellular firms such as Jio and Airtel. Scammers utilize this data, including names, addresses, phone numbers, and other identifying information, to carry out and personalize fraudulent operations like identity theft and phishing scams.

Knowing how con artists obtain and use this information highlights the significance of maintaining awareness about potential security concerns and exercising caution when safeguarding personal information.

Build Trust

Scammers use a variety of strategies to gain their victims’ trust, frequently by posing as reliable people or organizations like bank personnel or insurance agents. To give victims a false sense of authenticity and connection, they could even divulge personal information such as your KYC (Know Your Customer) details up front, making it harder for them to discover foul play.

Scammers establish their legitimacy by posing as respectable businesses or people on social media sites like Facebook or Instagram. This trickles victims into divulging additional personal information or making financial transactions. This dishonest conduct emphasizes how crucial it is to confirm identities and use caution when disclosing personal information online or in unsolicited contacts to protect yourself from scams.

Target a Strong Emotion

Once a scammer has gained their victim’s trust, they frequently use strong feelings like fear, greed, or benevolence to further manipulate them. For example, by pretending to be police enforcement and threatening legal action or presenting fictitious lottery riches, they may induce a sense of urgency or FOMO.

Scammers take advantage of victims’ weaknesses when threatening to reveal private information or compromise it unless a ransom is paid. This tactic is known as extortion. These strategies take advantage of victims’ emotions to force them to make snap judgments or reveal more personal information, increasing their fraudulent schemes’ impact.

To prevent becoming a victim of a scam, it is essential to be aware of these strategies to spot and steer clear of emotional manipulation of this kind.

Create Urgency

Creating a sense of urgency is a common tactic scammers use to manipulate their victims into making quick decisions without thinking critically. Scammers often impose deadlines or convey imminent threats to pressure individuals into acting hastily. For example, they might claim that immediate action is required to prevent financial loss and legal consequences or to claim a supposed prize or benefit.

By inducing urgency, scammers aim to override rational thinking and push victims into making impulsive decisions, such as sharing personal information, clicking on malicious links, or transferring money. Recognizing and questioning sudden urgencies in communications can help individuals avoid falling prey to such deceptive tactics and maintain better control over their personal and financial security.

Extract Money

Once scammers have successfully convinced their target, they proceed to their ultimate goal: extracting money. They frequently request payment via speedy, hard-to-trace payment channels like UPI (Unified Payments Interface) transfers.

UPI is widely used because it makes it easy to transfer money instantly between bank accounts using a mobile device. Scammers take advantage of this technique because UPI transfers are instantaneous, and without conventional banking safeguards like chargebacks, the money transmitted may be hard to retrieve or track down.

Types of UPI Frauds

Customer Care Fraud

Scammers impersonating reputable customer service representatives from banks or UPI service providers engage in customer care fraud related to UPI. They usually contact victims via texts, emails, or phone calls, and they sometimes use phony official numbers or fictitious communication channels.

Under the false impression that they are addressing problems or confirming accounts, these scammers trick victims into divulging private information, such as UPI PINs, OTPs, or banking information.

Once acquired, this data gives the con artists access to the victim’s UPI account, which they can utilize for fraudulent transactions.

It’s crucial to confirm the legitimacy of any correspondence purporting to be from customer support, avoid sending sensitive information over insecure channels, and get in touch with customer service directly using the approved channels supplied by the bank or UPI service provider.

Utility Bill Fraud

Sensitive information can leak from website data breaches, which scammers subsequently use for unscrupulous purposes. Scammers may use customer IDs or other personal information gleaned from these breaches to send text messages that look real in situations involving UPI or other financial transactions. They instill a sense of panic or urgency in their victims, forcing them to act fast and frequently, leading to rash choices like sending money or disclosing more personal information.

This strategy takes advantage of the victim’s fear of losing money or feeling secure to coerce them into acting right away, which can lead to identity theft or fraudulent transactions. It’s critical to exercise caution while confirming the legitimacy of messages, particularly those requesting immediate action or payment, to prevent falling for scams that originate from data breaches.

Money Transfer Fraud

Money transfer fraud includes a variety of dishonest tactics used to fool people into sending money to scammers under false pretenses. Phishing emails, phony job offers, romance scams, and bogus investment opportunities are some ways this might happen.

Fraudsters frequently take advantage of communication channels’ weaknesses or play on the emotions and trust of their victims in the context of UPI or other digital payment systems to force victims to initiate transactions. Because digital payments are instantaneous, it is usually difficult to retrieve money once received.

To avoid being a victim of money transfer fraud, one must exercise caution, be skeptical of demands for money that are not requested, and confirm the validity of any transactions.

Investment Fraud

Investment fraud involves scams where individuals are deceived into investing money in fictitious or misrepresented opportunities promising high returns. Scammers employ various tactics, such as fake investment schemes in stocks, cryptocurrencies, or real estate, often using fake websites, persuasive emails, or posing as legitimate financial advisors.

For instance, a common scam might offer unrealistic returns on cryptocurrency investment, exploiting victims’ desire for quick profits. Once funds are transferred, the fraudster disappears, leaving victims with substantial financial losses.

Avoiding investment fraud requires thorough research, skepticism towards unsolicited investment offers, and verifying the legitimacy of investment opportunities and advisors before committing funds.

Groups With Financial Motive

The researchers at Bolster have collaborated on a table containing the details of adversaries with financial motives.

| Adversary | ATT&CK Profile Link |

|---|---|

|

Carbanak or FIN7 |

https://attack.mitre.org/groups/G0008 |

|

SKELETON SPIDER or FIN6 |

https://attack.mitre.org/groups/G0037 |

| EVIL CORP | https://attack.mitre.org/groups/G0119 |

| TA505 | ttps://attack.mitre.org/groups/G0092 |

| Wizard Spider | ttps://attack.mitre.org/groups/G0102 |

5 Ways to Avoid Online Payment Frauds

1. Look for Red Flags

We should try to spot red flags before fraud occurs, such as spelling or grammatical errors in messages.

2. There is No Easy Money in This World

If you easily earn money without performing tasks, your money will double quickly; this is an alarming sign.

3. Beware of Untrustworthy Apps or Links

To avoid online scams, exercise caution with unsolicited communications and verify the authenticity of websites. Beware of untrustworthy apps or links that may lead to phishing attempts or malware installations.

4. Never Share Your OTPs or PIN

Never share your OTPs or PINs with anyone to avoid online scams, as legitimate entities do not require them to receive money transfers. Protecting this information helps prevent unauthorized access to your accounts and financial transactions.

5. Don’t Use Public Wi-Fi for Payments

Avoid online scams by refraining from making payments over public Wi-Fi networks, as they are vulnerable to interception by hackers, risking the security of your financial information.

Conclusion

To fight payment fraud effectively, it is necessary always to be alert and adjust accordingly since it is always changing. To avoid monetary loss and operational breakdowns, companies should be updated about what is happening now, understand weak spots linked to certain payment systems, and establish strong measures that can be used to detect or even prevent this particular act.

Even as criminals develop new ways, so should we think of new defenses that will enable us to prevent their innovation within this secure electronic platform.

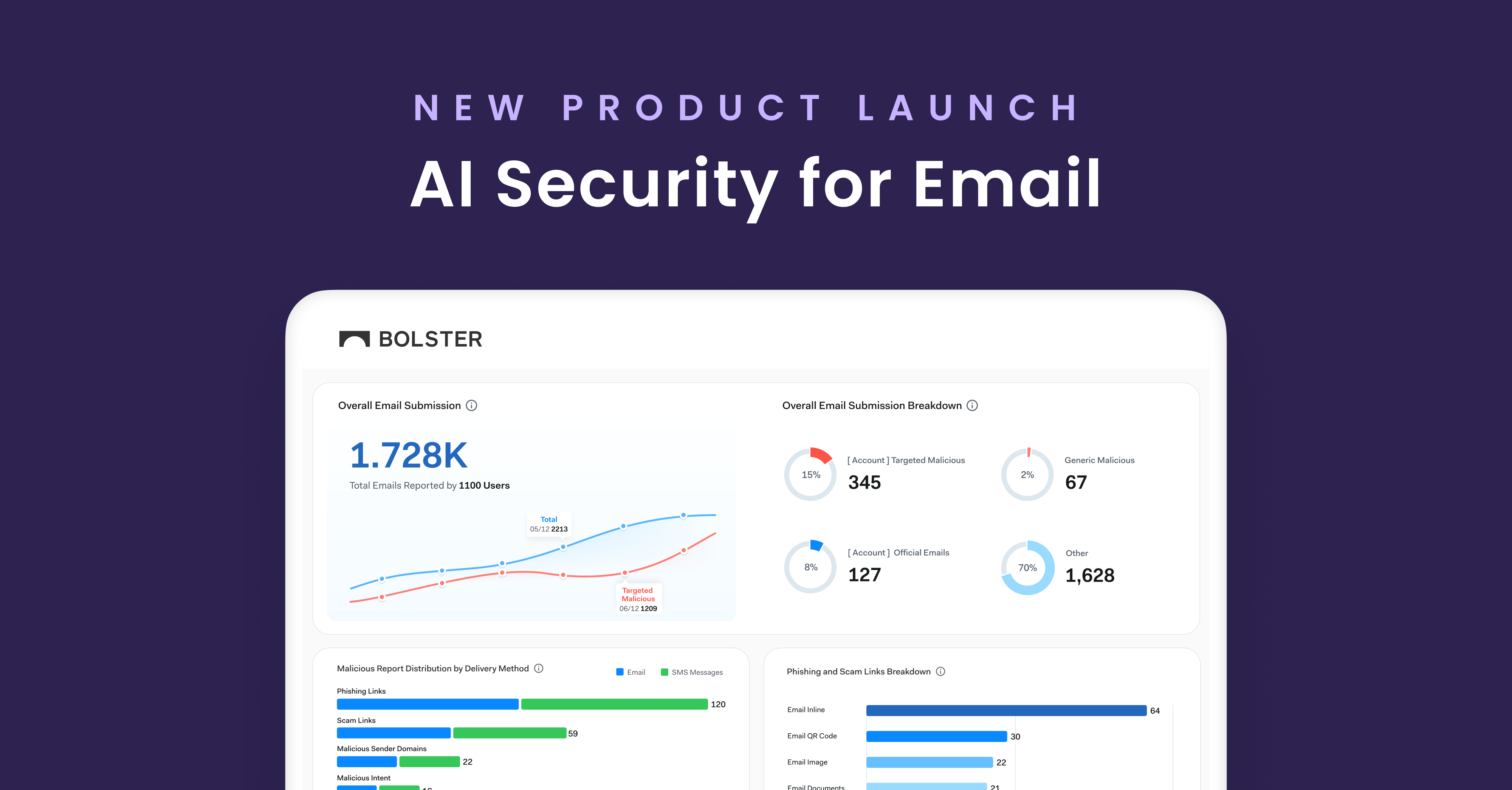

Stay ahead of criminals, and protect your business’s customers and employees from being the victim of financial and payment-related phishing scams. Contact us at Bolster to see how our AI-backed fraud protection can protect your business from these growing scam types.

References

https://economictimes.indiatimes.com/topic/financial-fraud

https://www.forbes.com/advisor/in/banking/common-bank-scams-and-how-to-avoid-them/